Student debt increases 57 percent over last decade

Holly Burke, 30, chose to pursue a degree in education seven years ago. A mother of one and a non-traditional student, Pell Grants eased the burden of tuition costs during the three years she studied at Mid Michigan Community College.

Now, Burke is $56,000 in debt and still a year away from graduation. Despite being so close, her degree may be in jeopardy.

"Last semester I cried to financial aid," Burke said. "Because of the (tuition) increase, I was unable to take another semester unless more aid was found. Their solution was to see if I can graduate right now with what I have. Give up my degree and just get the heck out."

Burke refused to leave CMU with an associate's degree after four years in the education program.

"I have one year left. I can't quit now," Burke said. "I will make less in a year than I owe them."

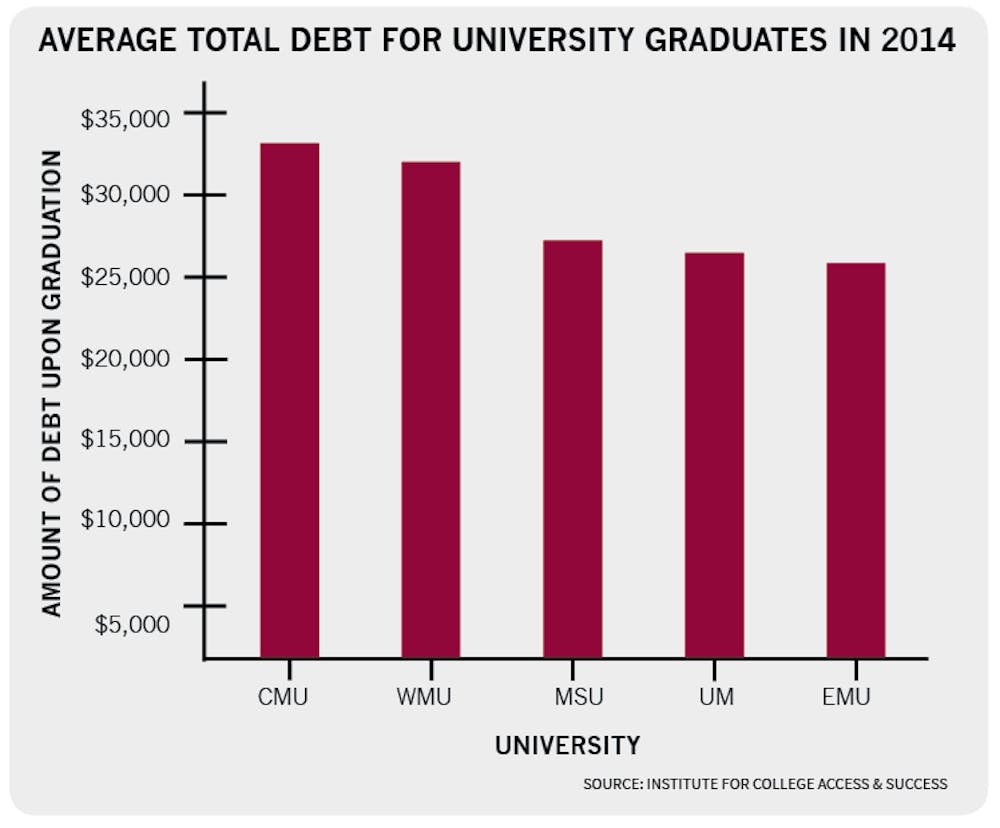

Burke's financial situation is becoming more common among education students, said Student Michigan Education Association President Kaileigh Schippa. Student debt upon graduation has increased by 57 percent in the last decade, according to a report by the Institute for College Access and Success. Michigan students have the ninth highest in the nation, with the average being $29,450.

"A big problem is that it used to be a four-year program and with everything added on, it's become five or even six years for some students," the Westland senior said.

SMEA is a branch of the National Education Association, the largest union in the country and one that lobbies for educators on issues such as the "No Child Left Behind" Act.

SMEA also advises students in education programs on opportunities to ease college debt, such as the little-known Public Service Loan Forgiveness Program.

By paying $125 per month, public servants can pay off college over the course of 10 years, Schippa said. Any debt left over at the end is forgiven.

Director of Scholarships and Financial Aid Kirk Yats tries to give students opportunities to pay off their debt, but admits that the financial burden of the current generation of students isn't comparable to his own time as an undergraduate at Ferris State and later as a graduate student at CMU in the 80s.

"It's a completely different world," Yats said. "Back then interest rates were lower, but more and more schools are having to contribute more of their own money for grants. When I was at Ferris, you could take out a loan and cover most of your tuition."