Report: More graduates defaulting on student loans, stagnating economic growth

Students who are unable to find work after college are struggling to repay loans.

A recent Fair Isaac Corp. report found that college students are struggling to repay growing student loan debts. FICO reviewed 10 million credit files and then generated statistics on student loan debt.

FICO found that the average debt per student has risen 58 percent between 2005 and 2012, a rise of more than $10,000.

By failing to repay their loans and defaulting, graduates are experiencing a major decrease in their credit scores. Lowered scores are making it harder for students to access further lines of credit, in turn stagnating economic growth. The lack of growth is making it harder to find work, therefore creating an unsustainable positive feedback loop.

“The number one reason (that the amount of debt is increasing so dramatically) is tuition is rising faster than standard inflation,” Economics Department Chairman Paul Natke said.

Also included in the FICO report are statistics on the quantity of loans. Between 2005 and 2012, the number of students with two or more loans grew exponentially from 12 million to 26 million.

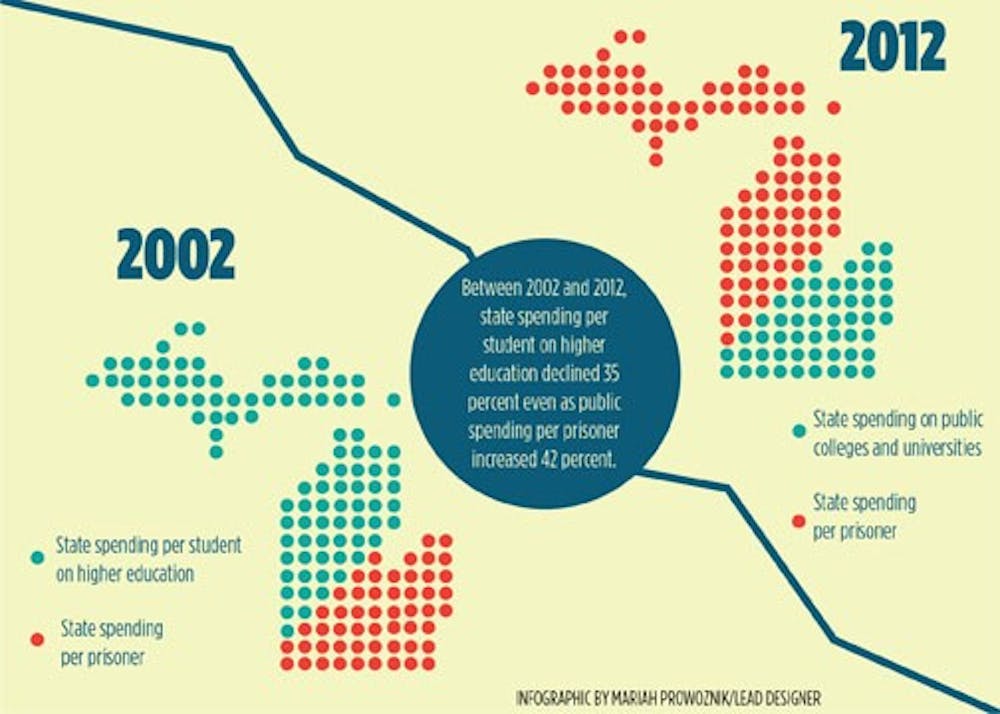

“Government support used to be much higher than it is today,” Natke said. “When I started at Central Michigan University 38 years ago, 25 percent of Central Michigan University’s revenue came from tuition and 75 percent came from government funding.”

According to the 2012-13 annual operating budget, state appropriations only accounted for about 20 percent, or $70 million, of CMU’s nearly $350 million total revenue.

“Part of that can be attributed simply to a change in the political landscape,” Natke said.

The report also reveals that 12.4 percent of the loans granted between 2005-07 are 90 days or more past due. That percentage is even higher for loans granted between 2010-12, at 15.1 percent.

However, Natke said finding a well-paying job requires some students to acquire debt.

“In order to remain competitive in the workforce, students need to have degrees,” Natke said. “They should be willing to take on the debt.”