Assurance of Insurance: CMU sought health insurance policy after discovering it's one of two universities in the state without

Mandated health insurance policy series, part two

An original political cartoon, created by Presentation Editor Caroline Sharbaugh, illustrates Central Michigan University pushing a pill onto international students that symbolizes the mandated health insurance policy.

Editor's Note: This article is the second story to a three-part series. Reporter Masha Smahliuk is an undergraduate international student. This did not affect reporting in any way.

Once the fall semester began for Central Michigan University, and domestic students were going about their new classes, international students had other pressing matters at hand. A newly mandated health insurance policy took effect Aug. 12, when $638.40 was charged to all international students' billing accounts. A group of international students took the initiative to advocate against the current insurance provider, GeoBlue, in order to have an option in what health insurance they are required to have.

Mohamed Elaswad is an international student from Egypt getting his Ph.D. in biochemistry and molecular biology. He is a part of a group of students, including Himal Roka, an international student from Nepal, that have been advocating all semester for changes to the insurance policy. Together, these students started an online petition against the mandated health insurance plan.

The petition is currently endorsed by the Student Government Association (SGA), Central Michigan University Faculty Association, International Student Organization (ISO), Nepali Student Association (NSA), Indian Student Association (ISA) and the Empowered Latino Union (ELU).

Within the petition, the following requests are listed:

· To allow international students to enroll in an external insurance plan that satisfies the equivalent benefits and coverage of the GeoBlue plan

· Students who decide to participate in the GeoBlue plan have an option to contribute each month

· A provision of health insurance for graduate assistants to be included along with stipend and tuition waiver

In addition, Elaswad, Roka and numerous other students created a survey to learn the opinions of international students regarding the insurance policy.

As of Oct. 11, nearly 300 students had taken the survey, the petition said. It revealed that 75.6% of respondents are self-funded; of those, 25% answered that the GeoBlue insurance fee is more than half of their monthly costs. Meanwhile, 47.6% of self-funded students said the insurance fee is 10-30% of their monthly expenses.

“In this survey, 92% of students answered that this policy is a financial burden, and 89% said this could cause mental distress to them,” the online petition said.

“Instead of students focusing on their academics and graduating and doing well in their classes, they will be focused more on how to make more money,” Elaswad said in an interview with Central Michigan Life.

This financial strain may cause international students to stop chasing their interests and aspirations in order to accommodate the costs they are required to pay, Roka said.

“The bill is already in our account, that’s the problem,” Roka said. “I’m a grad student. I can pay, but it’s still super expensive. … There are so many undergrads … here, and imagine the number of undergrads getting hit hard by this. And at the same time, imagine the grad students who are self-funded here.”

Soon after learning about the new policy, the group of students that created the petition and survey voiced their concerns to the Office of Global Engagement and Student Government Association.

“We’ve been working on this since the policy was announced,” Elaswad said.

The students are hoping to meet with the highest leadership on campus in order to make their concerns known, he said.

“If I were able to talk to President Davies, I would have said everything from our demands,” Elaswad said. “The main point here is that a lot of us will not be able to pay this money.”

Elaswad is encouraging people to spread awareness on the issue and sign the petition. He said anyone who wants to show support can sign it.

“We understand that it’s necessary for international students to have insurance, but having an option to have an external plan that is not mandated would make it less challenging for many of us,” Elaswad said.

Deepmala Rana Bhat, a second-year graduate student and the current president of ISO said she is not worried about graduate assistants being able to pay for the health insurance because their tuition is covered by the university and they earn a stipend. She mainly advocated for students in need and for whom insurance causes a financial burden.

Deepmala Rana Bhat stands in front the CMU seal Wednesday, Dec. 7 in the Warriner Mall.

“My main concern was students who can’t afford it,” Rana Bhat said.

She and Roka met to discuss the health insurance policy and students’ complaints about it. The ISO shared a link to the petition on their Instagram page and, according to Rana Bhat, invited Roka to speak about his concerns during the Barbecue Around the World event hosted in September.

“At that time, we were working together,” Rana Bhat said.

Afterwards, the petitioners, including Roka, Elaswad and others, addressed their concerns on Oct. 3 at a Student Government Association meeting and subsequently, wrote a letter to President Davies.

Meanwhile, ISO met separately with President Davies on Oct. 3.

Rana Bhat said a group of four ISO members met with President Davies and discussed resources for international students, including lack of bus stops, lack of part-time jobs and the mandated health insurance policy. She said ISO also addressed students’ complaints regarding the health insurance price and it not being mentioned in a document called I-20.

What is I-20?

I-20 is a document required by the federal government that every international student wanting to study in America must complete. It provides proof of eligibility for non-immigrant status.

It also demonstrates that students can afford tuition, housing and other expenses.

“We talked about it (the health insurance) not being affordable,” Rana Bhat said. “And that we heard from different students that in their I-20, (the health insurance) is not written. … So we asked him (President Davies) to at least mention (the health insurance) in I-20.”

Rana Bhat said the ISO informed President Davies of students discontent with the mandated insurance policy and asked him to confirm GeoBlue plan was the best option in terms of services it offers and price.

Last year, Rana Bhat said she used a health insurance plan through the ISO Student Health Insurance Company. It cost her $40 per month, but she said it had less coverage.

“I definitely want health insurance and I hope every student wants health insurance,” she said. “I don’t want a cheaper one. I want (an) affordable (policy) … (that) gives me lots of services and will help people.”

This fall, Carolina Hernandez Ruiz, a second-year student from Spain, was required to pay a first installment of $3,500 by Sept. 22 towards her overdue tuition or she would have to vacate her on-campus housing. She said she was unable to pay her tuition in the previous spring semester as a result of her father's job loss in early 2022.

Hernandez Ruiz was able to pay the deadline with the help of her family and a GoFundMe account. Nonetheless, the GoFundMe remains in order to assist her with the rest of her payment plan. She said she owes the university $4,000 by Dec. 21 and $6,000 next spring.

However, she echoed others concern about health insurance policy fees.

“Then I realized, 'Oh no, it's not $6,000 because I forgot to include the health insurance and I have to include the service fee for registration and all that stuff," she said. "So it will be around $8,000 or $8,500. (The health insurance) definitely adds more things that are unnecessary.”

Nonetheless, she has received more financial help recently. Hernandez Ruiz was recently awarded the $5,000 Lester Brooke Scholarship, which is applied to student accounts in two parts - half in the fall, half in the spring.

Previously, Hernandez Ruiz used Student Secure International Student Insurance, which was $432 for the entire calendar year and covered outpatient treatment, hospital room and board, intensive care, outpatient prescription drugs, emergency medical evacuation and dental treatment due to accident.

“So thinking that I will have to pay three times the price that I was paying for a health insurance I didn't choose, and especially for a health insurance I'm probably not going to use, it's very absurd,” she said.

Hernandez Ruiz said that health insurance is free in Spain, therefore she is not accustomed to worrying about it.

“It would literally be cheaper to go to Spain to get a surgery or to do something (rather than) staying here,” she said.

Luca Bonaldo, from Italy, studies physics and science of advanced materials for his PhD. Bonaldo said he didn’t know anything about the American health insurance system when he initially came to the U.S. He said he was grateful his physics professor made him aware that he would need health insurance.

“I was paying $87 — $65 for the first one (initial health insurance plan) — and my health insurance was good,” he said.

Bonaldo said the insurance was helpful when he cut his finger cooking and needed stitches. While he believes the GeoBlue plan is comprehensive, he said it is also very expensive.

“When I saw the price, I was worried for my salary if I (would be) able to pay $1,500 (per year)," Bonaldo said.

He currently works as a graduate assistant with a fixed stipend.

“I was surprised we couldn’t choose between different options,” he said. “I was disappointed that we couldn’t do anything in the decision process.”

If Bonaldo had had an opportunity to choose between staying on a GeoBlue plan or picking his own, he said he would have preferred his own plan.

He's not alone.

Hernandez Ruiz said she thinks health insurance for students is a great idea, but students should have the option to choose from other insurance providers as well as the option to abstain from purchasing health insurance altogether.

“A lot of people don't say anything because a lot of people may be scared of losing their visa,” she said. “I mean, I have my visa requirements so that's why I'm speaking up because I have everything correct.

“A lot of people (are in their first year) here, it's not their first language, … so, they don't question anything. They just try their hardest to pay this without anyone knowing that they are struggling.”

Why did CMU implement a health insurance policy?

The discussion of a mandated health insurance policy began in 2019, according to Executive Director of the Office of Global Engagement (OGE), Jennifer Evanuik. That was around the time when she and other faculty noticed that other universities had an insurance mandate for international students.

At the time, CMU was one of two universities without a comparable health insurance policy, Evanuik said.

When COVID-19 hit in 2020, the conversation regarding a health insurance policy ended, Evanuik said. However, she was eventually approached by two international student leaders, then-President of the International Student Organization (ISO) Mary Demirkol, and a former SGA senator.

“They both approached me to ask how can (OGE) support initiatives that they were undertaking to advocate for CMU to have an insurance policy for international students? And I said, ‘Oh, it's interesting that you're asking me that, because this is something we had kind of been thinking about,’” Evanuik said.

Evanuik also said other international students visited the OGE prior to COVID-19, to share their experience with medical situations that caused them significant debt.

“We encouraged students to have insurance, but it wasn't something that our office can really advise on because we're not insurance experts," she said. "So it was more like, ‘Hey, we strongly encourage you to get this when you're here.'"

Evanuik said she has heard students say that they wished CMU had done more to help them understand the intricacies of the American healthcare system.

“We worked with the ISO to communicate to the international student body that this (insurance policy) has been approved by the president because the ISO was equally as invested in the outcome as we were,” Evanuik said.

According to CMU’s website, the Office of Global Engagement mission statement is to “foster intercultural understanding and global perspectives among the Central Michigan University community.”

“We also are kind of advocates for international students throughout their experience here,” Evanuik said. “A lot of people come to us and share what's going on – successes or challenges. And then we often will work in collaboration with other campus offices to help ... advocate for their needs or do programming that would benefit the students.”

Rana Bhat said Demirkol's conversation with Evanuik last winter was initially intended to provide international students with access to healthcare.

“Lots of international students were not getting any health services,” Rana Bhat said. “Getting health services here is expensive. And some students were having troubles with health.”

The ISO presented the issue to Evanuik, but did not provide an insurance plan to choose, Rana Bhat said.

International students have said that it was a mistake for ISO to ask the Office of Global Engagement for health insurance, Rana Bhat said. However, she still strongly believes in the need for insurance.

“Getting health insurance was not a mistake,” Rana Bhat said. "It was a first step for (the) well-being of international students.”

“For me, insurance has been good,” she said. “But then if I could get (an) affordable one, I would definitely choose that one.”

On the insurance FAQ page, the previous ISO president Demirkol is quoted saying, "International student health insurance is not only a great improvement for international students but also a good step for Central Michigan University. I think it is a great relief for international students to have a health insurance to feel safe and have one less thing to worry about.”

Roka said ISO nor international students were involved with finding the insurance plan and didn’t agree to the price. He said the way that they quoted Demirkol on the policy page misrepresents international students.

Hernandez Ruiz agreed. She said the quote gives the message that the ISO president speaks for all international students, but that was not the case.

Previous ISO President Demirkol did not respond to numerous requests from Central Michigan Life for comment.

On behalf of the university, Executive Director of Communications Ari Harris said in an email that in fall 2021, the ISO requested that CMU offer an international student health plan. This is the meeting Evanuik was referring to when she said two international student leaders had approached her regarding an insurance policy.

"In response to (ISO’s) request, CMU conducted a study of plans and policies at more than 20 peer institutions. Twenty out of 21 peer institutions have an insurance mandate and also endorse a specific plan, policy and carrier," Harris wrote.

“We did research and found that we were by far an outlier in that we did not have this particular (bandage),” Evanuik said. “There were students, also student leaders who were asking for this, and they reported to us that they were getting very similar types of questions and concerns from their peers, which is why they approached us about it.”

After taking this into account, Evanuik said OGE reached out to the Counseling Center, Student Health Services and University Athletics for input on the subject. She said all three departments had seen students unable to afford necessary medical assistance because their insurance did not cover it or they had no insurance.

For example, Evanuik said students get free sessions at the Counseling Center, but in order to continue with another therapist outside of CMU, coverage is required. Evanuik said, in many instances, students ceased therapy because they could not afford it.

"Clearly many other universities are (mandating insurance for international students) and our own students (were) asking for this," Evanuik said, "it became clear that this was something we should bring up to the attention of leadership. So at that point, the president and his cabinet reviewed these kinds of proposals, and then ultimately the president approved to have this policy in place.”

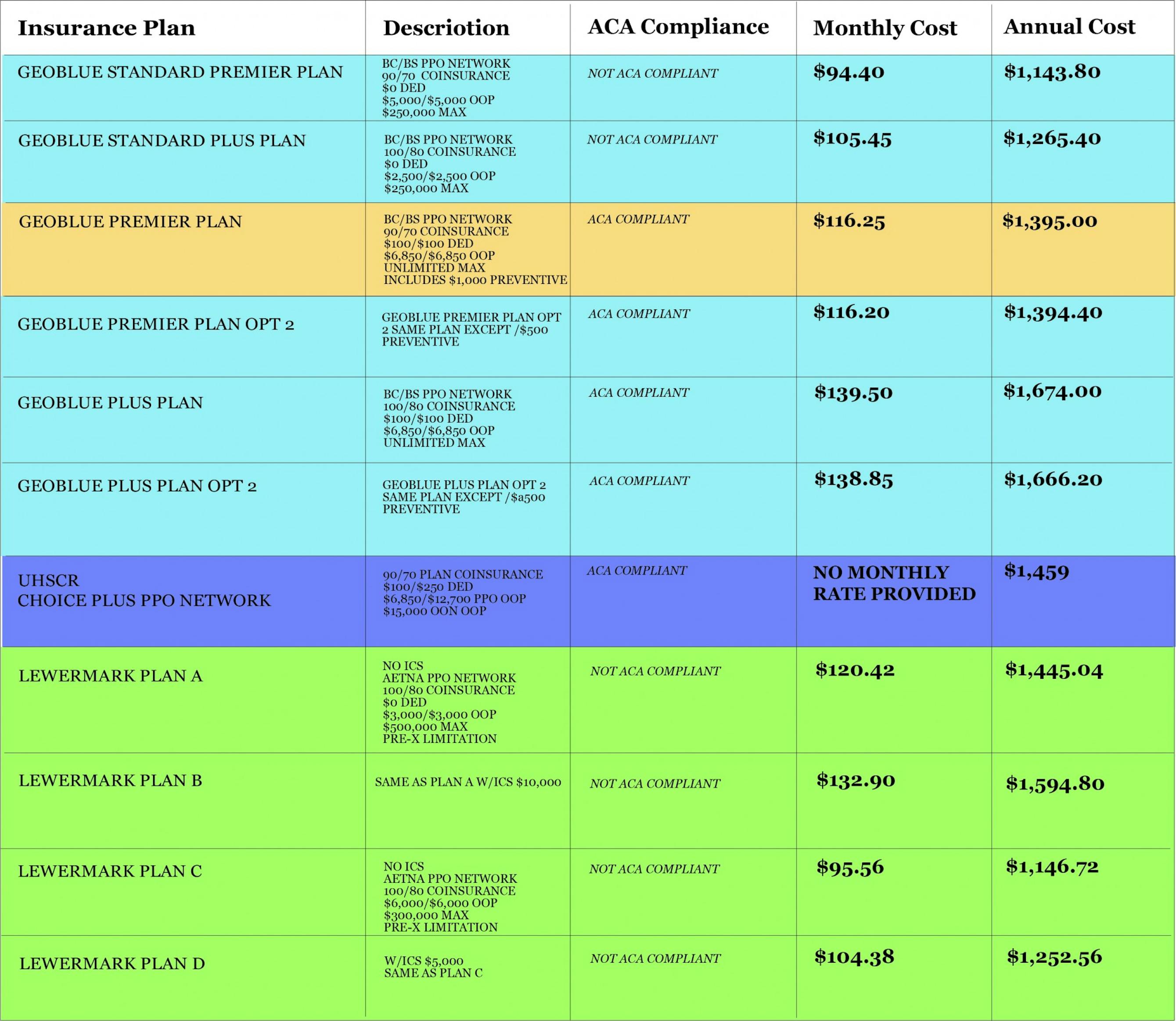

A look at alternative insurance providers serving comparable universities' international student population, created by Presentation Editor Caroline Scharbaugh.

Evanuik calculated the average cost per year, as seen above; even though the academic year spans nine months, it is a year long policy, she said. The average cost of all the plans combined was just over $800 per year, though many universities' insurance premiums are over $2,000 per year, Evanuik said.

CMU’s $1,500 policy is almost double the average.

GeoBlue was selected because it offered the only Affordable Care Act-compliant plan at a price point consistent with peer institutions, according to Harris.

“We want to make sure that while our students are here, that they do have access to healthcare," Evanuik said "And you never know when something is going to happen to you -- whether it's an emergency or an illness you didn't know you had or pregnancy -- to ultimately have your studies interrupted or to really be in medical danger because you weren't able to access the care you needed. That's kind of the angle we're looking at it from.”

What is GeoBlue?

GeoBlue is a study abroad and health insurance carrier provided by Blue Cross Blue Shield.

Central Michigan Life obtained a copy of the policy from CMU in response to a Freedom of Information Act (FOIA) request. The cost of insurance was quoted at $1,395 annually ($116.25 per individual per month); however, students are being charged $127.68 per month ($1,532.16 in total).

"Although the original quote CMU received from GeoBlue was listed at $116.25 per month, that was not the premium at the time of signing the contract, which was $127.68," Harris said in an email.

Most of Roka's professors were unaware of the insurance policy, but it sounded to them that “something behind the scenes is going on,” he said.

“And I can see what is going on, (the university) wants to make money from us,” Roka said.

However, when asked in an email if the university was overcharging students to accommodate administrative cost fees, Harris said otherwise.

"CMU does not charge an administrative fee. CMU does not receive any revenue, kickback or benefit from the international student health plan,” Harris wrote.

An original graphic, created by Presentation Editor Caroline Sharbaugh, provides terms and definitions to explain the jargon within the article that is utilized in health insurance.

More details and information about the GeoBlue plan:

- What are the extra costs? The GeoBlue Premier Plan requires policyholders to pay $100 in deductibles before the insurance is applied. The maximum out-of-pocket cost that policyholders can pay is $6,500 dollars per year, not including the cost of the premium itself.

- What does the coverage include? Doctor’s office visits, including limited treatment for things like injuries from sport clubs, preventive care services, pregnancy, mental and nervous disorders, diabetic supplies and cancer screenings, treatment at urgent care facilities, hospitals and physician outpatient services, in-patient hospital services and emergency hospital services. In-network services are covered after deductibles are satisfied.

- What is not included in the coverage? Dental or vision care, eye surgery, cosmetic surgery or organ transplants, diagnosis and treatment of acne and sleeping disorders, routine hearing tests; and nearly 30 other specific cases listed in the student handbook.

- What else? The policy covers global emergency services such as emergency medical evacuation up to $100,000, repatriation of remains up to $50,000 and emergency family travel arrangements up to $1,500. Students may use an app to access telehealth services that can connect them with international physicians.

According to CMU’s insurance proposals, also obtained through the FOIA request, GeoBlue quoted three plans: The Student Value plan ($89.40 per month or $1,072.80 per year), the Student Premier plan ($94.40 per month/$1,132.80 per year) and the Student Plus plan ($105.45 per month/$1,265.40 per year).

According to university documentation, the Student Value plan was “not recommended and is not summarized in this marketing report.”

Central Michigan Life also obtained the following information through its FOIA request. There were six total GeoBlue proposals as well as other offers from United Healthcare Student Resources (UHCSR) and LewerMark.

This original graphic, designed by Presentation Editor Caroline Scharbaugh, provides a look at competitive alternatives to the GeoBlue Premier Plan presented to the university.

The university selected the GeoBlue Premier plan. According to CMU’s website, the plan is mandatory, and outside health insurance plans will not satisfy the requirement.

GeoBlue does not provide coverage to international students outside of the U.S., so if students return home during the summer, they must continue to pay for a service they are not able to use.

CMU students can access resources provided by the insurance via the GeoBlue app.

Students receive an ID card to access their account, which is displayed on the app. According to CMU's GeoBlue international student insurance guide, students are able to utilize the app for healthcare services and find out-of-network providers or schedule an appointment with Blue Cross Blue Shield.

There is also a translation service to help with medications and medical terms. The telehealth service that can also be accessed in the app offers virtual calls with international doctors.

The two other candidates

CMU received three bids for the international student health insurance policy, obtained through CM Life's FOIA request. Aside from GeoBlue, the university received bids from UHCSR and LewerMark.

CMU utilized Mercer, a broker agency, to choose a health insurance provider.

According to Mercer, all proposals had an effective date of August 1, 2021. All proposals met visa requirements, and all premiums quoted included a 5% commission for Mercer.

UHCSR was quoted at $1,459 annually and is ACA compliant. If an institution has a student health center, the deductible would be waived and benefits would be paid at 100%, after a $15 physician’s co-pay.

This insurance plan provides telehealth services, including virtual medicine, counseling and psychiatric care, to insured students and their dependents.

LewerMark also offered an ACA-compliant plan through that, according to Mercer's proposals, was not competitive nor included in the summaries.

It did provide four ACA non-compliant policies that included a student-assistance program with mental health counseling 24/7 with no limit. Additionally, it proposed 24/7/365 telehealth access through a medical help line.

Read the first part of this series, click the link here.

CLARIFICATION: ISO President Deepmala Rana Bhat was incompletely identified in the original story, published Dec. 16. This story was updated Dec. 19 to reflect her full name; Central Michigan Life apologizes for the omission.